In 2020 the Australian government JobKeeper policy provided eligible employers and employees with a wage subsidy, which was designed to sustain employment during a COVID-related shock to the Australian economy.

Public universities were eligible for JobKeeper, but its regulations were changed several times to reduce the chance that they would qualify. I assessed the merits of the government’s university JobKeeper decisions in a previous post. No university received JobKeeper directly, although some benefited from it via their subsidiaries.

With most university annual reports now published I can partially investigate the effects of the government’s university JobKeeper decisions. As at 6 July 2021 I have 2020 financial results for 32 public universities. I am missing the South Australian universities, the University of Canberra, the University of Tasmania, and Charles Sturt University.

Time period of revenue loss

For all organisations JobKeeper eligibility involved comparing revenue in 2020 with the same period in 2019. Most organisations could choose a month or quarter, but for universities it was changed to the six month period from 1 January 2020. In my previous post, I rated this as the least defensible government university JobKeeper decision.

Early on, before the six month period was introduced, some universities thought that they could qualify (eg Sydney and La Trobe in April).

The original one month comparison option, starting with a calendar month that ends after 30 March 2020, seemed to create opportunities for some universities. Government payments arrive in fortnightly instalments, while fees are paid around due dates. In particular months international student fees received for the next semester may be a large percentage of all university income. A big drop in fee revenue in one of those months might have triggered the revenue decline threshold that made an employer eligible for JobKeeper assistance (the relevant level is discussed below).

At least at Sydney, most first semester 2020 student fee due dates were prior to 30 March (I could not find La Trobe’s dates). And Sydney is one of the ‘China universities’ affected by a border closure to China from 1 February 2020. The ‘India universities’ are unlikely to have had a March trigger month, as Indian students mostly arrived before the international borders closed completely to routine travel on 20 March 2020.

Fortunately for Sydney and other ‘China universities’, Chinese students were more willing to study online than previously thought. But that also made it much less likely that ‘China universities’ could qualify for JobKeeper in any of its permutations. While annual revenue figures cannot be entirely conclusive about cash flow in a single month, Sydney’s annual report shows that its total international student revenue increased on 2019, with overall revenue down just 3.5 per cent. It’s hard to see how Sydney could have qualified under any version of JobKeeper.

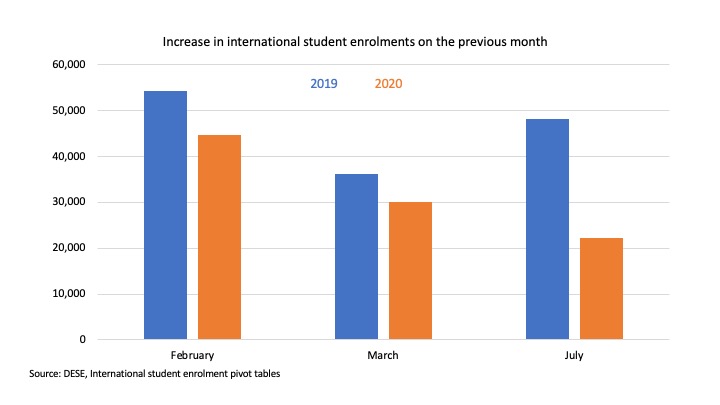

On a one month rule, however, second semester was more promising for JobKeeper eligibility than first semester. As the chart below shows, in July 2019 international student enrolments, and presumably fees, spiked as second semester students arrived. In 2020 the July increase was much reduced. But how many, if any, universities had revenue declines that were large enough depends on which JobKeeper revenue decline category they fell into.

Classification of universities in the JobKeeper scheme

JobKeeper had three main eligible organisation categories: businesses (except banks and a few other business types), not-for-profits that are not registered charities, and charities registered with the ACNC.

Which category an organisation fell into had consequences for JobSeeker eligibility: a 15 per cent decline in income over one of the relevant periods discussed above for registered charities, and for the others a 30 per cent decline in income for organisational revenue below $1 billion, and a 50 per cent decline in income for revenue above $1 billion.

Universities briefly thought that they would, due to their ACNC registrations, be classified with other charities. However, that turned out to be a case of the perils of government by tweet, with the Treasurer announcing via Twitter the 15 per cent rate, but omitting to note that universities and private schools were not included. In my previous post I rated the government’s decision on this point as reasonable, given significant differences between public universities and other registered charities.

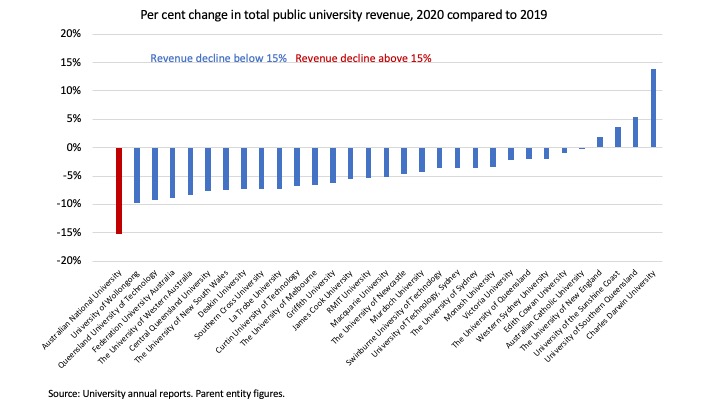

With the continuing caveat about cash flow timing issues, we can examine overall university revenue declines, as calculated from their annual reports. On an annual basis only one university, the ANU, would have met a 15 per cent decline requirement, with none anywhere near 30 or 50 per cent. Universities in the 7–10 per cent revenue decline range might have used a bad July to qualify on 15 per cent.

Classification of government revenue

Despite being put on a business/not-for-profit revenue loss test of at least 30 per cent, some universities still thought they might get JobKeeper. This was because the original JobKeeper revenue calculation was largely based on ‘GST turnover’. But government payments to government-related entities (which covered all public universities except ACU in 2020) are not included in the legal definition of GST turnover.

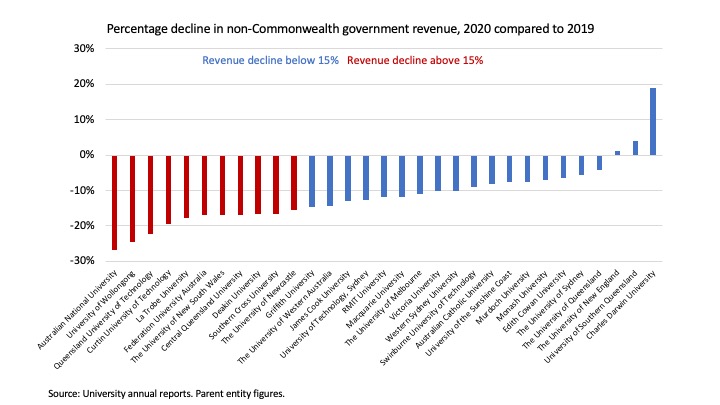

Excluding government payments would significantly lower the revenue base from which university income must fall before JobKeeper is triggered. In 2019 government grants and HELP revenue were 47 per cent of all income at the 32 universities in my dataset. And because government payments to universities increased slightly (2.1 per cent) in 2020 this income source was not contributing to JobKeeper trigger revenue declines.

Once the government realised that their own payments were not included in the revenue test, the rules were changed. Appropriations paid to universities under the Higher Education Support Act 2003 and the Australian Research Council Act 2001 were added to the revenue base for JobKeeper calculations. In my previous post, I rated this decision as sound and consistent with the overall design of JobKeeper.

But if the government payment rules had not been changed, and the 15 per cent rule charities rule had been in place, then a longer list of universities would have qualified for JobKeeper – eleven in the chart below on an annual basis, and more in the 10 to 14 per cent range, suggesting that a bad month could have triggered eligibility.

But if, as was the case, the business/not-for-profit 30/50 per cent revenue decline rules applied, no universities would clearly have hit the trigger points for JobKeeper even after excluding income from government appropriations. Wollongong, QUT and the ANU were the closest with revenue declines above 20 per cent, but the latter two are in the billion dollar plus revenue club, and so faced a 50 per cent decline in revenue to get JobKeeper.

The public universities that received JobKeeper via their subsidiaries

Although no public universities themselves met the final JobKeeper eligibility rules, at least twelve – Macquarie, UNE, UNSW, UTS, Sydney, Western Sydney, Charles Sturt, Southern Cross Monash, RMIT, UQ and UWA – received it via one or more subsidiaries. The true number may be higher, as some of these indirect JobKeeper receiving universities were identified via the NSW Audit Office report on universities rather than my word search on their annual reports. I am also waiting on information from the annual reports of a further five universities.

One university that noted the affected subsidiary was Monash, with its Monash College pathway provider triggering a $17.7 million JobKeeper payment. With short courses offered largely to international students Monash College did not have a pipeline of current students in longer degrees or other revenue sources.

Conclusion

Without month-to-month university cash flow data I cannot say for sure how much the JobKeeper rules that applied specifically to universities affected their ultimate eligibility. But based on the annual figures only with every JobKeeper decision going the other way – including them with other registered charities, ignoring their government revenue, and letting one bad month determine the result – can we get to a significant minority looking like they might be contenders.

Whatever judgments we reach on the substantive issues, public universities did not generally qualify for JobKeeper because their financial circumstances did not warrant it on the rules that applied to other enterprises. Although 2020 international student revenue was significantly lower than universities expected, especially from Chinese students it did not fall by as much as many (including myself) feared in the first few months of the pandemic. Public universities are large, diversified businesses and slightly increasing income from their biggest customer, the Australian government, made it harder to reach the JobKeeper turnover decline requirements.

As my previous post argued, JobKeeper was designed for revenue shocks caused by domestic lockdowns and activity restrictions, on the assumption that firms which retained their employees could bounce back quickly after freedoms were restored. It was not designed to deal with a two-plus year international border closure, which due to the nature of multi-year courses will cause loss of fee revenue into the mid-2020s. This situation always required a custom-designed response, one that was partially delivered for 2021, but is still needed for 2022.